Is There A State Income Tax In Nebraska . Your average tax rate is 10.94% and your. if you make $70,000 a year living in nebraska you will be taxed $10,983. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. Customize using your filing status,. nebraska income tax is imposed on all income which is earned while a resident of this state. the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. You may reduce your federal. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income.

from www.templateroller.com

Customize using your filing status,. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. if you make $70,000 a year living in nebraska you will be taxed $10,983. nebraska income tax is imposed on all income which is earned while a resident of this state. Your average tax rate is 10.94% and your. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. You may reduce your federal. the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.

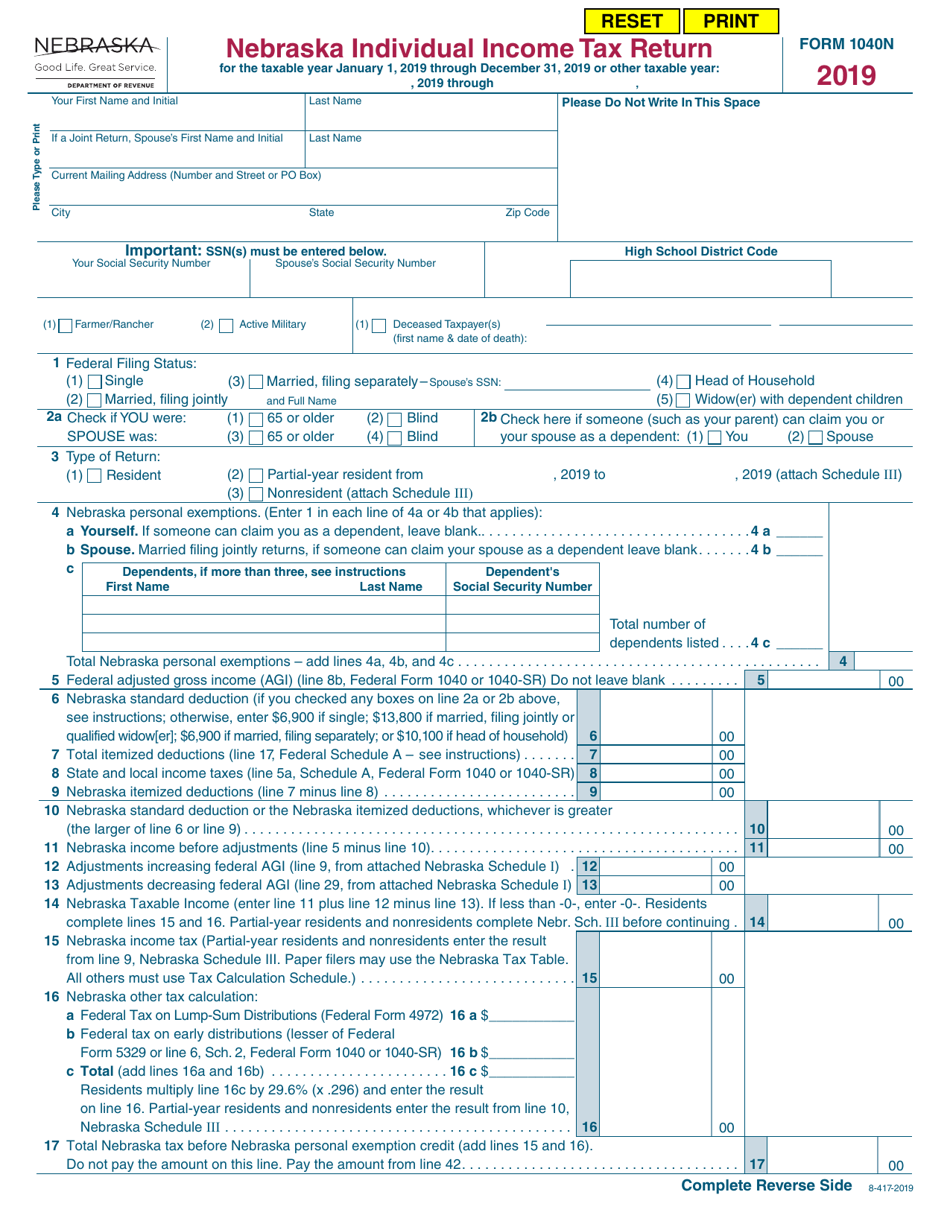

Form 1040N 2019 Fill Out, Sign Online and Download Fillable PDF

Is There A State Income Tax In Nebraska Customize using your filing status,. You may reduce your federal. if you make $70,000 a year living in nebraska you will be taxed $10,983. Customize using your filing status,. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. Your average tax rate is 10.94% and your. nebraska income tax is imposed on all income which is earned while a resident of this state. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. in nebraska, all types of income are generally subject to personal income tax unless they are specifically.

From support.joinheard.com

Paying State Tax in Nebraska Heard Is There A State Income Tax In Nebraska You may reduce your federal. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. Customize using your filing status,. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and. Is There A State Income Tax In Nebraska.

From printableformsfree.com

Nebraska Fillable Tax Forms Printable Forms Free Online Is There A State Income Tax In Nebraska in nebraska, all types of income are generally subject to personal income tax unless they are specifically. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. Customize using your filing status,. Your average. Is There A State Income Tax In Nebraska.

From www.caliper.com

Maptitude Map Per Capita State Taxes Is There A State Income Tax In Nebraska in nebraska, all types of income are generally subject to personal income tax unless they are specifically. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. You may reduce your federal. if you make $70,000 a year living in nebraska you will be taxed $10,983. the nebraska department of. Is There A State Income Tax In Nebraska.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Is There A State Income Tax In Nebraska Customize using your filing status,. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. You may reduce your federal. nebraska income tax is imposed on all income which is earned while a resident of this state. in nebraska, all types of income are generally subject to personal income tax. Is There A State Income Tax In Nebraska.

From hxesqzqsa.blob.core.windows.net

Tax Percentage For Paycheck In Nebraska at Richard Morales blog Is There A State Income Tax In Nebraska You may reduce your federal. Your average tax rate is 10.94% and your. if you make $70,000 a year living in nebraska you will be taxed $10,983. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and. Is There A State Income Tax In Nebraska.

From nebraskaexaminer.com

Lawmakers pass Nebraska tax cuts, property tax offsets, child Is There A State Income Tax In Nebraska the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. Customize using your filing status,. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. if. Is There A State Income Tax In Nebraska.

From www.tax-brackets.org

Nebraska Tax Brackets 2024 Is There A State Income Tax In Nebraska Customize using your filing status,. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. if you make $70,000 a year living in nebraska you will be taxed $10,983. Your average tax rate is 10.94% and your. You may reduce your federal. nebraska income tax is imposed on all. Is There A State Income Tax In Nebraska.

From giotchbtd.blob.core.windows.net

Nebraska State Tax Questions at Jack Childress blog Is There A State Income Tax In Nebraska Customize using your filing status,. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. nebraska income tax is imposed on all income which is earned while a resident of this state. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. . Is There A State Income Tax In Nebraska.

From www.moaa.org

MOAA Tax Update New Law Helps Retirees in Nebraska, Updates on Is There A State Income Tax In Nebraska nebraska income tax is imposed on all income which is earned while a resident of this state. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. You may reduce your federal. the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. nebraska. Is There A State Income Tax In Nebraska.

From www.zrivo.com

Nebraska State Tax 2023 2024 Is There A State Income Tax In Nebraska nebraska income tax is imposed on all income which is earned while a resident of this state. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. Your average tax rate is 10.94% and your. if you make $70,000 a year living in nebraska you will be taxed $10,983. Customize. Is There A State Income Tax In Nebraska.

From www.dochub.com

Nebraska state tax Fill out & sign online DocHub Is There A State Income Tax In Nebraska Your average tax rate is 10.94% and your. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. if you make $70,000 a year living in nebraska you will be taxed $10,983. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income.. Is There A State Income Tax In Nebraska.

From www.zippia.com

100k AfterTax By State [2023] Zippia Is There A State Income Tax In Nebraska 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. You may reduce your federal. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. if. Is There A State Income Tax In Nebraska.

From taxfoundation.org

2019 State Individual Tax Rates and Brackets Tax Foundation Is There A State Income Tax In Nebraska 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. Your average tax rate is 10.94% and your. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. nebraska income tax is imposed on all income which is earned while a resident. Is There A State Income Tax In Nebraska.

From hxesqzqsa.blob.core.windows.net

Tax Percentage For Paycheck In Nebraska at Richard Morales blog Is There A State Income Tax In Nebraska Your average tax rate is 10.94% and your. if you make $70,000 a year living in nebraska you will be taxed $10,983. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. Customize using your filing status,. in addition to your federal tax obligations, nebraska collects state taxes from. Is There A State Income Tax In Nebraska.

From giotchbtd.blob.core.windows.net

Nebraska State Tax Questions at Jack Childress blog Is There A State Income Tax In Nebraska if you make $70,000 a year living in nebraska you will be taxed $10,983. 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. in nebraska, all types of income are. Is There A State Income Tax In Nebraska.

From taxfoundation.org

2020 State Individual Tax Rates and Brackets Tax Foundation Is There A State Income Tax In Nebraska Customize using your filing status,. if you make $70,000 a year living in nebraska you will be taxed $10,983. Your average tax rate is 10.94% and your. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. You may reduce your federal. the nebraska department of revenue, along with. Is There A State Income Tax In Nebraska.

From wisevoter.com

Median Household by State 2023 Wisevoter Is There A State Income Tax In Nebraska in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. the nebraska department of revenue, along with many other state revenue agencies, is requesting additional information for. Customize using your filing status,. in nebraska, all types of income are generally subject to personal income tax unless they are specifically. 100. Is There A State Income Tax In Nebraska.

From giotchbtd.blob.core.windows.net

Nebraska State Tax Questions at Jack Childress blog Is There A State Income Tax In Nebraska 100 rows find out how much you'll pay in nebraska state income taxes given your annual income. in addition to your federal tax obligations, nebraska collects state taxes from income, property and sales. nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. Customize using your filing status,. . Is There A State Income Tax In Nebraska.